If you’d like to split up profits and losses in a way that is not proportionate to the members’ percentage interests in the business, it’s called a “special allocation,” and you must carefully follow IRS rules. For instance, if Jimmy owns 60% of the LLC, and Luana owns the other 40%, Jimmy will be entitled to 60% of the LLC’s profits and losses, and Luana will be entitled to 40%. Most operating agreements provide that a member’s distributive share is in proportion to his percentage interest in the business. Each LLC member’s share of profits and losses, called a distributive share, is set out in the LLC operating agreement.

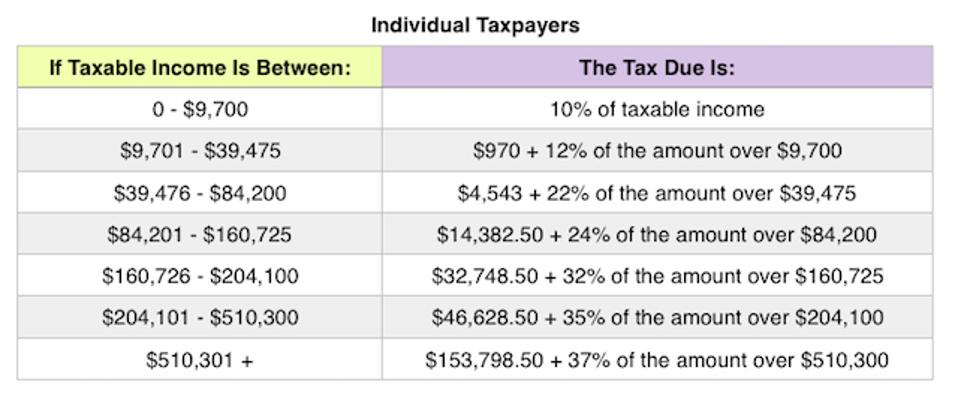

Co-owned LLCs themselves do not pay taxes on business income instead, the LLC owners each pay taxes on their lawful share of the profits on their personal income tax returns (with Schedule E attached). The IRS treats co-owned LLCs as partnerships for tax purposes. Even if you leave profits in the company’s bank account at the end of the year-for instance, to cover future expenses or expand the business-you must pay taxes on that money. This means that the LLC itself does not pay taxes and does not have to file a return with the IRS.Īs the sole owner of your LLC, you must report all profits (or losses) of the LLC on Schedule C and submit it with your 1040 tax return. The IRS treats one-member LLCs as sole proprietorships for tax purposes. If not, here are the basics: Single-owner LLCs If you’ve already done business as a sole proprietorship or partnership, you’re ahead of the game because you know many of the rules already. The IRS treats your LLC like a sole proprietorship or a partnership, depending on the number of members in your LLC. The LLC itself does not pay federal income taxes, but some states do charge the LLC itself a tax. All of the profits and losses of the LLC “pass through” the business to the LLC owners (called members), who report this information on their personal tax returns.

0 kommentar(er)

0 kommentar(er)